![]()

5824 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

HARYANA GOVERNMENT

FINANCE DEPARTMENT

The 28th October, 2016

No. 1/20/2016(RP)-5PR(FD)— In exercise of the powers conferred by the proviso to article 309 of the Constitution of India, the Governor of Haryana hereby makes the following rules, namely:-

1. Short title and commencement.—

(1) These

rules may be called the Haryana Civil

Services (Revised Pay) Rules,

2016.

(2) These rules shall be deemed to have come into force on the 1st day of January, 2016, unless

otherwise provided by

the

Government for any class

or category of persons;

2. Categories of Government

employees to whom these rules apply.—

(1) Save

as otherwise

provided under these

rules, it shall apply to the persons

appointed to civil services and posts in connection with the affairs of the Government of Haryana, who are under the

administrative control of the

Government of Haryana and

whose pay is debitable to the Consolidated Fund of the State

of Haryana.

Note.— These rules shall also be applicable to re-employed pensioners including military pensioners, who

are drawing

pay

in the existing pay structure subject

to revision of pension

from 1st January, 2016.

(2) These

rules shall not apply to—

(b) Officers of judicial services working in connection with the affairs of Government of Haryana;

(c) Persons not in whole time employment;

(d) Persons paid otherwise than on monthly basis, including those paid on a piece rate basis or on daily wages basis or on contract basis or appointed under outsourcing policies; (e) Government employee who is drawing his pay in a pay scale under Haryana Civil Services

(Assured Carrier progression) rules with effect from the date on which he started drawing his pay in the pay scale under Haryana Civil Services (Assured Carrier progression) rules and till the time he draws his pay in that pay scale;

(f) Any other class or category of persons whom the Government may, by order, specifically exclude from the operation of all or any of the provisions contained in these rules.

3. Definitions.—

In these rules, unless the context otherwise requires—

(a) “basic pay in the revised pay structure” means the pay drawn in the prescribed Level in the Pay Matrix but does not include any other type of pay like special pay, etc;

(b) “CSR” means the Civil Services Rules applicable to Haryana Government employees as amended

from time to time;

(c) “direct recruit” with reference to a post or a Government employee means the post on which such Government employee was recruited as a regular and direct recruit fresh entrant in the Government service;

(d) “existing basic pay” means pay in the existing functional pay band on the date of option plus functional Grade Pay of the post as on 31st December,2015 held by the person, it does not include any other type of pay like “special pay”, “personal pay” etc;

Exception: Where a higher pay structure (other than ACP pay structures) has been

sanctioned by the competent authority to a Government employee as a measure personal to him, his

basic pay in that pay structure shall

be

treated the existing basic

pay.

(e) “existing emoluments” means the sum of (i) existing basic pay and (ii) existing dearness allowance at index average as on 1st day of January 2016. It does not include interim relief or any other relief or emoluments;

![]()

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5825

(f) “existing Pay Band and Grade Pay/Scale”

or “existing pay

structure”

in relation to a

Government employee means the present

system of Pay Band and Grade Pay or Higher

Administrative Grade applicable to the post held by a Government employee as on the date immediately before the coming into force of these rules whether in a substantive or officiating capacity;

Explanation: The expressions “existing Pay Band and Grade Pay/Scale”

or “existing pay structure”, in

respect of a Government employee who on the 1st day of January, 2016 was on deputation

out

of India or on leave or on foreign service, or who would have on that date officiated in one or more lower posts but for his officiating in a higher post, shall mean such basic pay, Pay

Band and Grade Pay or scale in relation to the post which he would have held but for

his

being on deputation out

of

India or on leave or on foreign service or officiating in higher post,

as the case may be;

(g) “functional pay structure

or functional level”

in relation to a Government employee means the functional level in pay matrix prescribed for the post held by him. It does not mean any other level in which the Government employee is drawing his pay as a measure personal to him with any other justification like length of service, or higher/additional qualification or upgradation of

pay scale due to any other reason;

(h) “Government employee” means the Government employees to whom these rules apply under

rule

2;

(i) “Government” means the Government of the State of Haryana in the Finance Department

save as otherwise provided by or under these rules;

(j) “leave” means any sanctioned leave as defined in Civil Services Rules, except “casual leave”. Any type of absence without the sanction of competent authority shall not be

considered as leave;

(k) “applicable level” in the Pay Matrix shall mean the Level corresponding to the Pay Band and Grade Pay/ scale

as on 1st January, 2016 specified in

Schedule-I ;

(l) “memorandum explanatory” means the memorandum explanatory appended

to these rules,

briefly explaining

the

nature, philosophy, justification, objectives,

applicability etc. of these

rules;

(m) “officiating

appointment” means appointment of a Government employee on a permanent

or

temporary post as a temporary measure. The appointment of a Government employee working on regular basis is also to be considered as officiating during the period of probation;

(n) “pay in the

level” means pay drawn in the appropriate Cell of the Level as specified in the

Schedule-I ;

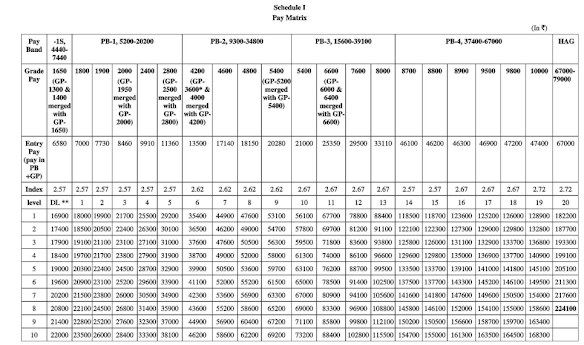

(o) “pay matrix” means Matrix specified in the Schedule-I , with Levels of pay arranged in vertical cells

as assigned to corresponding existing pay

band and grade pay/scale;

(p) “pay scale as a

measure personal to a Government employee” means any pay structure

granted by the competent authority to a Government employee as a measure personal to

him. It does not include ACP pay structure or any other pay structure granted

for possessing additional

qualification etc;

(q) “pay” means

the amount

drawn monthly

by

a Government employee,

other than special pay or pay granted in lieu

of

his personal qualification

or his length of service, in the functional pay structure,

which has been sanctioned for a post held by him in substantively or in an officiating capacity or in case where no separate functional pay scale is sanctioned for the post held by the Government employee constituting a cadre, in the pay scale to which he is entitled by reason of his

position in a cadre;

(r) “persons” means persons

who

are Government

employees

for

the purposes of these rules;

(s) “revised

emoluments” means revised

pay in the level of a Government employee in the revised pay structure;

(t) “revised pay structure” in relation to a post means revised level in pay matrix corresponding to

the

existing Pay Band and Grade Pay or existing pay

structure of the post

unless a different revised Level is notified separately for that post;

(u) “schedule”

means schedule appended to these rules;

![]()

5826 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

(v) “substantive pay” means pay drawn by a Government employee on the post to which he

has been appointed substantively or by reason of his/her substantive position

in a cadre;

Note.— A Government

employee who

has been appointed temporarily to a post

while still drawing his salary in his earlier pay scale or in any other pay scale except the pay

scale prescribed for the post on which he has been appointed, will not be deemed to have been appointed against such post either in the officiating capacity or in the substantive capacity for the

purposes

of these

rules.

4. Level of posts.—

(a) The functional Level of post shall be determined in accordance with the various Levels as assigned to the corresponding existing

functional Pay Band and Grade Pay or scale as specified in Pay

Matrix in the Schedule-I .

(b) Where the functional pay scale of a post was ` 6500-10500 as on 31st December, 2005 and thereafter revised to PB-2 with Grade Pay ` 4200 w.e.f. 1st January, 2006, the revised level of that post applicable w.e.f. 1st January, 2016 shall be 7 (seven) corresponding to Grade Pay ` 4600. However, where the functional pay scale of a post was less than ` 6500-10500 and upgraded to

Grade Pay ` 4200 on or after 1st January, 2006 shall not be covered under this provision of upgradation, e.g. Pay Scale of JBT Teacher was ` 4500-7000 and that of Staff Nurse was ` 5000-7850 as on 31st December, 2005, which were revised to PB-2, Grade Pay ` 4200 w.e.f. 1st January,

2006. The revised level of JBT Teacher and Staff Nurse shall be 6 (six) in the new Pay Matrix

applicable w.e.f.

1st January, 2016.

(c) The functional level of the post of Lab Technician (General) of the Department of Health Services,

Haryana shall be Level-6 (six) of Pay Matrix (existing Grade Pay ` 2800 to be upgraded to Grade Pay ` 4200 (corresponding Level-6 (six)).

(d) Where existing functional grade pay of Group A post is ` 5400 in PB-2 or PB-3, the corresponding revised Pay Level shall be 10 (ten) of the Pay Matrix for all the employees appointed on such posts

by way of direct recruitment or otherwise subject to the condition that these posts are of Group A as

specified in the Service Rules.

5. Drawal

of pay in the revised

pay structure.—

Save as otherwise provided in these rules, a Government employee shall draw pay in the Level in the

revised pay structure applicable to the post

to which he

is appointed:

Provided that a Government employee may elect to continue to draw pay in the existing pay structure until the date on which he earns his next increment or until he vacates his post or ceases to draw pay in the existing

pay

structure.

Provided further that in cases where a Government employee has been promoted or appointed from one post to another of higher grade pay or scale,

between 1st day of January, 2016 and the date of

notification of these rules may elect to switch over to the revised pay structure from the date of such promotion, 1st July, 2016 or subsequent appointment, as the case may be.

Explanation 1.— The option to retain the existing pay structure under the provision of this rule shall be admissible only in respect of one existing Pay Band and Grade Pay / Scale.

Explanation 2.— Where Grade Pay of a post has been merged with higher grade pay or upgraded, the employee promoted to such post, between the period from 01.01.2016 and the date of notification, may opt for revised pay structure from a date of promotion or 1st July, 2016 but in that case the existing basic pay admissible in the pay structure as on 31.12.2015 of the promotional post shall be taken into account.

Explanation 3.— The aforesaid option shall not be admissible to any person appointed to a post for the first time in Government service by direct recruitment or otherwise on or after the 1st day of January, 2016, and he shall be allowed pay only in the revised pay structure.

6. Exercise of option.—

(1) The option under the provisos to rule 5 shall be exercised

in writing in the form appended to these rules

so as to reach the authority

mentioned in sub-rule (2) within three months from―

(a) the

date of notification of these rules; or

(b) the date where revision in the existing

pay structure and/or refixation of pay with

retrospective effect is made by any order subsequent to the date of notification of these rules;

![]() HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5827

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5827

Provided that in the case of a Government employee who is, on the date of such notification or, as the case may be, date of such order, out of India either on leave or deputation or foreign service, the said option shall be exercised in writing so as to reach the said authority within three months of the date of his taking charge of his post in India;

Provided further that where a Government employee is under suspension on the 1st day of January, 2016, the option may be exercised within three months of the date of his return to his duty if that date is later than the date prescribed in this sub-rule.

(2) The option shall be intimated by the Government employee to the Head of his office alongwith an undertaking, in the form appended to these rules.

(3) If the intimation regarding option is not received within the time mentioned in sub-rule (1), the Government employee shall be deemed to have elected to be governed by the revised pay structure w.e.f. the 1st day of January, 2016.

(4) The option once exercised shall be final.

Note 1.— Persons whose services were terminated on or after the 1st January, 2016, and who could not exercise the option within the prescribed time limit, on account of death, discharge on the expiry of the sanctioned post, resignation, dismissal or removal on account of disciplinary proceeding, shall be entitled to exercise option under sub-rule (1).

Note 2.— Persons who have died on or after the 1st day of January, 2016, and could not exercise the option within the prescribed time limit are deemed to have opted for the revised pay structure on and from the 1st day of January, 2016, or such later date as is most beneficial to their dependents, if the revised pay structure is more favorable and in such cases, necessary action for payment of arrears should be taken by the Head of Office.

Note 3.— Persons who were on earned leave or any other leave on 1st day of January, 2016 which entitled them to leave salary shall be entitled to exercise option under sub-rule (1).

(1) The pay of a Government employee who elects or is deemed to have elected under rule 6 to be governed by the revised pay structure on and from the 1st day of January, 2016, shall, unless in any

case the Government by special

order otherwise directs, be fixed separately in respect of his

substantive pay in the permanent

post

on which he holds

a lien or would have held a

lien if it had not

been

suspended, and in respect of his pay in officiating post held by him, in the following manner namely:-

(A) In the case

of all employees―

(i) the pay in the applicable Level in the Pay Matrix shall be the pay obtained by multiplying

the

existing basic pay by a factor of 2.57, rounded off to the nearest rupee and the figure so arrived at will be located in that Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell

in that applicable Level of the Pay Matrix.

Illustration

1:

|

1. |

Existing Pay Band : |

PB-1 |

|

2. |

Existing Grade Pay : |

` 2,400 |

|

3. |

Existing Pay in Pay Band : |

` 10,160 |

|

4. |

Existing basic

pay : |

` 12,560

(10,160+2,400) |

|

5. |

Pay after multiplication by a fitment factor of 2.57 :

12560 x 2.57 = |

` 32,279.20

(rounded off to 32279) |

|

6. |

Level corresponding to GP 2400 : |

Level 4 |

|

7. |

Revised Pay in Pay Matrix (either

equal to or next higher to ` 32279 in Level 4) : |

` 32,300 |

![]() 5828 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

5828 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

|

Grade Pay |

1800 |

1900 |

2000 |

2400 |

2800 |

|

Levels |

1 |

2 |

3 |

4 |

5 |

|

1 |

18000 |

19900 |

21700 |

25500 |

29200 |

|

2 |

18500 |

20500 |

22400 |

26300 |

30100 |

|

3 |

19100 |

21100 |

23100 |

27100 |

31000 |

|

4 |

19700 |

21700 |

23800 |

27900 |

31900 |

|

5 |

20300 |

22400 |

24500 |

28700 |

32900 |

|

6 |

20900 |

23100 |

25200 |

29600 |

33900 |

|

7 |

21500 |

23800 |

26000 |

30500 |

34900 |

|

8 |

22100 |

24500 |

26800 |

31400 |

35900 |

|

9 |

22800 |

25200 |

27600 |

32300 |

37000 |

|

10 |

23500 |

26000 |

28400 |

33300 |

38100 |

|

11 |

24200 |

26800 |

29300 |

34300 |

39200 |

(ii) Where Grade Pay has been merged with higher Grade Pay or upgraded, the basic pay as on 1st January, 2016 in the pre-revised pay structure (as before merging) shall be taken into account at the time of initial fixation of pay from unrevised to revised pay structure adopting above said formula, as clarified in the illustration 2 below:-

Mr. T was drawing Grade Pay ` 3600 as on 1st January, 2016 while working on a post of Assistant. The functional Grade Pay of this post has been merged to ` 4200 and the

corresponding Level is 6 in the Pay Matrix. His pay in the revised level shall be fixed as

under:-

|

1. |

Existing Pay Band : |

PB-2 |

|

2. |

Existing Grade Pay :

(merged with GP ` 4200) |

` 3,600 |

|

3. |

Grade Pay after merger |

` 4,200 |

|

4. |

Existing Pay in Pay Band : |

` 15,000 |

|

5. |

Existing basic pay : |

` 18,600

(15,000 +3,600) |

|

6. |

Pay after multiplication by a fitment factor of 2.57 : |

` 18,600

x 2.57 = 47,802 |

|

7. |

Level corresponding to GP ` 4,200 : |

Level 6 |

|

8. |

Revised Pay in Pay Matrix

(either equal to or next higher to

` 47,802 in Level 6) : |

` 49,000 |

|

Grade Pay |

GP 2800 |

GP 4200 |

GP 4600 |

|

Level |

Level 5 |

Level 6 |

Level 7 |

|

1 |

29200 |

35400 |

44900 |

|

2 |

30100 |

36500 |

46200 |

|

3 |

31000 |

37600 |

47600 |

|

4 |

31900 |

38700 |

49000 |

![]() HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5829

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5829

|

5 |

32900 |

39900 |

50500 |

|

6 |

33900 |

41100 |

52000 |

|

7 |

34900 |

42300 |

53600 |

|

8 |

35900 |

43600 |

55200 |

|

9 |

37000 |

44900 |

56900 |

|

10 |

38100 |

46200 |

58600 |

|

11 |

39200 |

47600 |

60400 |

|

12 |

40400 |

49000 |

62200 |

|

13 |

41600 |

50500 |

64100 |

|

14 |

42800 |

52000 |

66000 |

(iii) Where a Government employee has been promoted between the period from 1st January, 2016 and the date of notification, to a post the Grade Pay of which has been merged with higher grade pay or upgraded, opt for revised pay structure from a date later than 1st January, 2016 but in their case the pay structure as on 31st December, 2015 of the post held by him on the date of option shall be taken into account, as clarified in the illustration 3 below :-

Illustration 3: Mr. P was working as Labour Inspector in the grade pay of ` 3600/-. He was promoted to the post of Labour Officer in GP-4200/- w.e.f. 01.08.2016, the GP of the post of Labour Officer is upgraded from GP-4200/- to GP-4600/- w.e.f. 1st January, 2016 , Mr. P opted revised pay rules from the date of promotion. The pay of Mr. P will be fixed in the following manner:-

|

1. |

Existing Pay Band : |

PB-2 |

|

2. |

Existing pay as on

01.07.2016 as Labour

Inspector: |

` 23,300 (19,700 + 3,600) |

|

3. |

Date of promotion : |

01.08.2016 |

|

4. |

Existing grade pay of promotional

post: |

` 4,200 |

|

5. |

Upgraded grade pay of promotional

post: |

` 4,600 |

|

6. |

Pay as Labour Officer

on 01.08.2016 in the

pay structure as on 31.12.2015

i.e. PB-2, Grade

Pay 4200 |

20400+4200 = 24600 |

|

7. |

Pay fixed as

Labour Officer after multiplication by the fitment factor i.e. (24,600 x 2.57= ` 63,222 in

Level-7): |

` 64,100 |

|

Grade Pay |

GP 4200 |

GP 4600 |

GP 4800 |

|

Level |

Level 6 |

Level 7 |

Level-8 |

|

1 |

35400 |

44900 |

47600 |

|

2 |

36500 |

46200 |

49000 |

|

3 |

37600 |

47600 |

50500 |

|

4 |

38700 |

49000 |

52000 |

|

5 |

39900 |

50500 |

53600 |

|

6 |

41100 |

52000 |

55200 |

![]() 5830 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

5830 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

|

7 |

42300 |

53600 |

56900 |

|

8 |

43600 |

55200 |

58600 |

|

9 |

44900 |

56900 |

60400 |

|

10 |

46200 |

58600 |

62200 |

|

11 |

47600 |

60400 |

64100 |

|

12 |

49000 |

62200 |

66000 |

|

13 |

50500 |

64100 |

68000 |

|

14 |

52000 |

66000 |

70000 |

(iv) If the minimum pay or the first Cell in the applicable Level is more than the amount

arrived at as per sub-clause (i), (ii) or (iii) above, the pay shall be fixed at minimum pay or the first Cell

of

that applicable Level.

(B) In the case of Medical Officers in respect of whom Non-Practicing Allowance (NPA) is admissible,

the pay in the

revised pay structure shall

be

fixed in the following manner:-

(i) the existing basic pay shall be multiplied by a factor of 2.57 and the figure so arrived at shall

be added to by an amount equivalent to Dearness Allowance on the pre-revised Non-Practicing Allowance admissible as on 1st day of January, 2016. The figure so arrived at

will be located in that Level in the Pay Matrix and if such an identical

figure corresponds

to any Cell in the applicable level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell

in that applicable Level of the

Pay

Matrix;

(ii) the pay so fixed under sub-clause (i) shall be added by the pre-revised Non Practicing

Allowance admissible on the existing basic pay until further decision on the revised rates

of

Non-Practicing Allowance.

Illustration: 4:

|

1. |

Existing Pay Band : |

PB-3 |

|

2. |

Existing Grade Pay : |

` 5,400 |

|

3. |

Existing pay in Pay

Band : |

` 15,600 |

|

4. |

Existing basic pay : |

` 21,000 |

|

5. |

25% NPA on Basic Pay : |

` 5,250 |

|

6. |

DA on NPA @ 125%

: |

` 6,563 |

|

7. |

Pay after multiplication by a fitment factor of 2.57 : 21,000 x 2.57 = 53,970 |

` 53,970 |

|

8. |

DA on NPA : |

` 6,563 (125% of 5,250) |

|

9. |

Sum of serial number 7 and 8 = |

` 60,533 |

|

10. |

Level

corresponding to Grade Pay

` 5400 (PB-3) : |

Level 10 |

|

11. |

Revised Pay in Pay Matrix (either

equal to or next higher to `60,540 in Level 10) : |

` 61,300 |

|

12. |

Pre-revised Non Practicing

Allowance : |

` 5,250 |

|

13. |

Revised Pay + pre-revised Non Practicing Allowance : |

` 66,550 |

![]() HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5831

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5831

|

Grade Pay |

5400 |

6600 |

7600 |

|

Levels |

10 |

11 |

12 |

|

1 |

56100 |

67700 |

78800 |

|

2 |

57800 |

69700 |

81200 |

|

3 |

59500 |

71800 |

83600 |

|

4 |

61300 |

74000 |

86100 |

|

5 |

63100 |

76200 |

88700 |

|

6 |

65000 |

78500 |

91400 |

Note 1.― A Government employee who is on leave including Study Leave on the 1st day of January, 2016, and is entitled to leave salary shall be entitled to pay in the revised pay structure from 1st day of January, 2016 or the date of option for the revised pay structure.

Note 2.― In case

of

Government employee

under suspension,

he

shall continue to draw subsistence allowance based on existing

pay structure and his pay in the revised pay structure will be subject to final order

on

the pending disciplinary

proceedings

or otherwise a final order, as the

case may be.

Note 3.― Where the ‘existing emoluments’ exceed the revised emoluments in the case of any Government employee, the

difference shall be allowed as

personal

pay

to be absorbed in future increases in pay.

Note 4.― Where a Government employee is in receipt of personal pay immediately before the date of notification of these rules, which together with his existing emoluments exceed the revised

emoluments, then the difference representing such excess shall be allowed to such Government employee as

personal pay

to be absorbed in future increase

in

pay.

Note 5.― (a) Where in the fixation of pay under sub-rule (1), the pay of a Government employee, who, in the existing pay structure was drawing immediately before the 1st day of January, 2016, more pay than another Government employee junior to him in the same cadre, gets fixed in the revised pay structure in a cell lower than that of such junior, his pay shall be stepped up to the same cell in the revised pay structure as that of the junior.

(b) In case where a senior Government employee promoted to a higher post before the 1st day of January, 2016, draws less pay in the revised pay structure than his junior who is promoted to the higher post on or after the 1st day of January, 2016, the pay of the senior Government employee should be stepped up to an amount equal to the pay in the pay

structure as fixed for

his junior in that

higher post. The stepping up should be done with effect from the date of promotion of the junior Government employee.

The stepping up under (a) and (b) above shall be done subject to the fulfillment of the following

conditions, namely:-

(i) both the junior and the senior Government employees should belong to the same cadre and the posts in which they have been promoted should be identical in the same cadre;

(ii) the existing pay structure and the revised pay structure of the lower and higher posts in which they

are

entitled to draw pay should be same;

(iii) the senior Government employee at the time of his promotion should have been drawing equal or more pay than that of the junior;

(iv) the anomaly is directly as a result of the application of the provisions of Civil Services Rules or any

other rule or

order regulating pay fixation on such promotion in the revised

pay structure:

Provided that

if the junior

officer was

drawing more pay in the existing pay structure than

the senior by virtue of any advance increment(s) or otherwise granted to him on a personal measure, the provisions of

this sub-rule shall not be invoked to step up the

pay

of the senior officer.

(c) After re-fixation of the pay of the senior employee in accordance with clause (a) and (b), he shall be entitled to the next increment on completion of his required qualifying service with effect from the date of re-fixation of pay.

![]()

5832 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

8. Fixation of pay

of employees appointed first

time in Government service by direct recruitment

or otherwise on or after 1st day of January, 2016.―

The pay of employees appointed first time in service by direct recruitment or otherwise on or after 1st day of January, 2016 shall be fixed at the minimum pay or the first Cell in the Level, applicable to the post to which such employees are appointed:

Provided that where the existing

pay of such employee appointed on

or

after 1st day of January, 2016 and

before the date of

notification of these rules,

has already been fixed in the existing

pay structure and if his

existing emoluments happen

to exceed the minimum pay or the first Cell in

the Level, as applicable to the post

to which he

is appointed on or

after 1st day of January, 2016,

such difference shall

be

paid as personal pay to be absorbed in

future

increments in pay.

9. Increments

in Pay Matrix .―

The increment

in the pay matrix

shall be as specified in the vertical Cells of the applicable Level

in the Pay Matrix.

Illustration

5 :

An employee in the Basic Pay of ` 32,300 in Level 4 will move vertically down the same. Level in the

cells and on grant of increment, his basic

pay

will be ` 33,300.

|

Grade Pay |

1800 |

1900 |

2000 |

2400 |

2800 |

|

Levels |

1 |

2 |

3 |

4 |

5 |

|

1 |

18000 |

19900 |

21700 |

25500 |

29200 |

|

2 |

18500 |

20500 |

22400 |

26300 |

30100 |

|

3 |

19100 |

21100 |

23100 |

27100 |

31000 |

|

4 |

19700 |

21700 |

23800 |

27900 |

31900 |

|

5 |

20300 |

22400 |

24500 |

28700 |

32900 |

|

6 |

20900 |

23100 |

25200 |

29600 |

33900 |

|

7 |

21500 |

23800 |

26000 |

30500 |

34900 |

|

8 |

22100 |

24500 |

26800 |

31400 |

35900 |

|

9 |

22800 |

25200 |

27600 |

32300 |

37000 |

|

10 |

23500 |

26000 |

28400 |

33300 |

38100 |

|

11 |

24200 |

26800 |

29300 |

34300 |

39200 |

10. Date of next increment in the

revised pay structure.―

(1) There shall be two dates for grant of increment namely, 1st January and 1st July of every year,

instead of existing date of 1st

July:

Provided that an employee shall be entitled to only one annual increment either on 1st January or 1st

July depending on

the date of his appointment, promotion

or grant

of financial upgradation.

Provided further that a Government employee who does not complete six months qualifying service

before the date of normal increment due on 1st July or 1st January, as the case may be, his date of

next increment shall be changed to 1st January or 1st July and shall be granted subject to admissibility.

(2) The increment in respect of an employee appointed or promoted or granted financial upgradation

during the period between the 2nd day of January and 1st day of July (both inclusive) shall be

granted on 1st day of January and the increment in respect of an employee appointed or promoted

or

granted financial upgradation during the period between the 2nd day of July and 1st day of

January (both inclusive) shall be granted on

1st day of July.

(a) In case of an employee appointed or promoted

in the normal hierarchy during the period

between the 2nd day of July, 2016 and the 1st day of January, 2017, the first increment

![]()

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5833

shall accrue on the 1st day of July, 2017 and thereafter it shall accrue after one year on annual

basis.

(b) In case of an employee appointed or promoted in the normal hierarchy during the period between 2nd day of January, 2016 and 1st day of July, 2016, who did not draw any

increment on 1st day of July, 2016, the next increment shall accrue on 1st day of January,

2017

and thereafter it

shall accrue after one year

on annual basis:

Provided that in the case of employees whose pay in the revised pay structure has been fixed as on

1st

day of January, the next increment in the Level in which the pay was so fixed as on 1st day of

January, 2016

shall accrue on 1st day of July, 2016:

Provided further

that the next increment

after drawal of increment on 1st day of July,

2016

shall accrue

on 1st day of July, 2017.

11. Fixation

of pay from

a date subsequent

to the 1st day of January, 2016.―

Where a Government employee continues to draw his pay in the existing pay structure is brought over to the revised pay structure from a date later than the 1st day of January, 2016, his pay from the later date in the

revised pay structure shall be fixed in accordance with clause

(A)

of sub-rule (1) of rule 7.

A Government employee who has officiated

in a post prior to the 1st day of January, 2016, but was not holding that post on that date and who on subsequent appointment to that post draws pay in the revised pay

structure shall be allowed the benefit of the provisions in Civil Services Rules to the extent it would have been admissible had he been holding that post on the 1st day of January, 2016, and had elected the revised pay structure on and from that date.

13. Fixation of pay on promotion on or after 1st day of January, 2016.― The fixation of pay in case of promotion from one post to another in the higher or identical Level of revised pay structure shall be made

in the following manner, namely:-

(i) One increment shall be given in the Level from which the employee is promoted and he shall be placed at a Cell equal to the figure so arrived at in the Level of the post to which promoted and if

no such Cell is available in the Level to which promoted, he

shall be placed at the next higher Cell

in that

Level.

(ii) On enhancement in presumptive pay of feeder post due to increment or otherwise while working

on

promotional post, the pay of promotional post shall be re-fixed as if the incumbent has been promoted on the date of such enhancement, if it is advantageous to him, as provided in rule 4.14

(2)

of Punjab Civil Services

Rules Volume-I Part-I, applicable prior to 19th July 2016 and

Rule 21 of Haryana Civil Services

(Pay) Rules

2016, applicable from 19th July,

2016.

|

1. |

Level of pay of feeder post

: |

Level 7 |

|

2. |

Basic Pay in the Level of feeder post as on 01.01.2016 : |

` 52,000 |

|

3. |

Date of next increment |

01.07.2016 |

|

4. |

Date of promotion from

Level 7 to Level 8 |

01.02.2016 |

|

5. |

Level of pay of promotional post |

Level 8 |

|

6. |

Pay after adding one increment

in Level 7 of feeder post |

` 53,600 |

|

7. |

Pay as on the date of

promotion in the Level of promotional

post

i.e. Level 8 : |

` 53,600

(either equal

to or next higher to

` 53,600 in Level

8) |

|

8. |

Date of next increment

in the Level 8 of promotional post. |

01.01.2017 |

|

9. |

Presumptive Pay of the feeder post

as on 01.07.2016

after adding one normal increment due on that

day. |

` 53,600 |

|

10. |

Re-fixation of pay

of promotional

post due to enhancement in

presumptive pay of

feeder post as per provision in Rule 4.14(2) of Pb. CSR Volume-I, Part-I. |

` 55,200 |

|

11. |

Date of next increment |

01.07.2017 and so on. |

|

Grade Pay |

4200 |

4600 |

4800 |

|

Levels |

6 |

7 |

8 |

|

1 |

35400 |

44900 |

47600 |

|

2 |

36500 |

46200 |

49000 |

|

3 |

37600 |

47600 |

50500 |

|

4 |

38700 |

49000 |

52000 |

|

5 |

39900 |

50500 |

53600 |

|

6 |

41100 |

52000 |

55200 |

|

7 |

42300 |

53600 |

56900 |

Illustration 7: Fixation of

pay on promotion of an

employee Mr. B from Level 4 to Level

5

|

1. |

Level of pay of feeder post

: |

Level 4 |

|

2. |

Basic Pay as on 01.01.2016 in

the Level of feeder

post: |

` 27,900 |

|

3. |

Date of next increment |

01.07.2016 |

|

4. |

Pay on annual

increment as on

01.07.2016 |

` 28,700 |

|

5. |

Date of next increment |

01.07.2017 |

|

5. |

Date of Promotion |

01.12.2016 |

|

6. |

Level of pay of promotional post |

Level 5 |

|

7. |

Pay after adding one increment

in Level 4 of feeder post |

` 29,600 |

|

8. |

Pay as on the date of

promotion in the Level of promotional

post

i.e. Level 5 : |

` 30,100 |

|

9. |

Date of next increment |

01.07.2017 and so on. |

|

Grade Pay |

2400 |

2800 |

4200 |

|

Levels |

4 |

5 |

6 |

|

1 |

25500 |

29200 |

35400 |

|

2 |

26300 |

30100 |

36500 |

|

3 |

27100 |

31000 |

37600 |

|

4 |

27900 |

31900 |

38700 |

|

5 |

28700 |

32900 |

39900 |

|

6 |

29600 |

33900 |

41100 |

|

7 |

30500 |

34900 |

42300 |

![]()

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5835

Illustration 8: Fixation of

pay on promotion in identical/

same level after merger:-

Before 01.01.2016, the Grade Pay of School Principal was ` 6000 and Grade pay of promotional post

namely District Education Officer was

` 6400.

Now, Grade Pay of ` 6000 and ` 6400 of all the posts have been merged with Grade Pay

` 6600 and

the

feeder and promotional posts have come in identical Level-11. Pay of a Principal on promotion

as District Education Officer will be

fixed as under:-

|

1. |

Level of pay of feeder as

well as promotional post

: |

Level 11 |

|

2. |

Basic Pay as on 01.07.2016 in

the Level of Principal |

` 88,400 |

|

3. |

Date of next increment |

01.07.2017 |

|

4. |

Date of promotion as DEO |

31.08.2016 |

|

5. |

Level of pay of promotional post |

Level 11 |

|

6. |

Pay after giving one

increment in Level

11 of feeder post |

` 91,100 |

|

7. |

Date of next increment |

01.07.2017 and so on. |

|

Grade Pay |

5400 |

6600 |

7600 |

|

Level |

10 |

11 |

12 |

|

1 |

56100 |

67700 |

78800 |

|

2 |

57800 |

69700 |

81200 |

|

3 |

59500 |

71800 |

83600 |

|

4 |

61300 |

74000 |

86100 |

|

5 |

63100 |

76200 |

88700 |

|

6 |

65000 |

78500 |

91400 |

|

7 |

67000 |

80900 |

94100 |

|

8 |

69000 |

83300 |

96900 |

|

9 |

71100 |

85800 |

99800 |

|

10 |

73200 |

88400 |

102800 |

|

11 |

75400 |

91100 |

105900 |

|

12 |

77700 |

93800 |

109100 |

(iii) In the case of Government employees receiving Non-Practicing

Allowance, their basic pay plus Non-Practicing Allowance shall not exceed the average of basic pay of the revised scale applicable to the HAG

Level (` 2,24,100) and the Level of the Chief Secretary (` 2,25,000) which comes

to ` 2,24,550.

14. Mode of payment

of arrears

of pay.―

The arrears

shall be paid in cash,

preferably during

the current financial year

2016-17. Explanation:-

For the purposes of this rule:

(a) “arrears of pay” in

relation to a Government employee means the difference between:

the aggregate of the pay and dearness

allowance to which he is entitled on account of the revision of his pay under these rules, for the period effective from the 1st day of January, 2016 and the aggregate of the pay and dearness allowance to which he would have been entitled (whether such

![]()

5836 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

pay and dearness allowance had been received or not) for that period had his pay and allowances

not been

so revised;

(b) The Interim Relief ` 2,000/- (Two thousand rupees only) per month paid to Group C and D employees is discontinued from 1st January, 2016 and the same paid from 01.01.2016 onwards

shall be recovered from them.

(c) The Risk Allowance of Rs. 5,000/- (Five Thousand rupees

only) per month granted to the

personnel of Haryana Police and Prisons Department Haryana vide instructions dated 19th December, 2013

shall be continued till

such time as may be separately ordered by

the Government.

15. Overriding

effect of rules.―

The provisions of Civil Services Rules or any other rules made in this regard shall not, save as otherwise provided in these rules, apply to cases where pay is regulated under these rules to the extent they are inconsistent with these rules.

16. Power

of relax.―

Where the Government is satisfied that the operation of all or any of the provisions of these rules causes

undue hardship in any particular case, it may, by order, dispense with or relax the requirements of that rule

to such extent and subject

to such conditions

as it may consider necessary for dealing with

the

case in a just and equitable manner.

Note.― The relaxation so granted under this rule shall be deemed to have been given depending upon the

merit of such class and categories of Government employees and therefore, will not amount to any

discrimination with other

class and categories of

Government employees.

17. Power

to make addition or deletion etc.―

Where the Government is satisfied

that there is a necessity to make additions or delete any class or

categories of posts or change the designations and structure of pay either permanently or temporarily in the schedules of these rules, the Government will be competent to add or delete or change such conditions. The

provisions of these rules will apply on such additions or deletions or changes as the Government may direct by specific

orders or in the absence

of that all

the

provisions of these rules

shall apply as if the changes

were made.

18. Interpretation.―

If any question arises relating to the interpretation of any of the provisions of these rules, it shall be referred to the Finance Department

through the Administrative Department concerned.

19. Residuary provisions.―

In the event of any general or special circumstance which is not covered under these rules or about which

certain inconsistency comes to the notice, the matter shall be referred to the Government and Government

will prescribe the conditions to be followed under such circumstances. Such conditions as prescribed by the

Government under this rule shall be deemed to be part of these rules. Further, if the Government is satisfied that there is a requirement to prescribe certain additional conditions under these rules, the Government shall

prescribe such conditions and such additional conditions as prescribed by the Government under this rule

shall be deemed to be

the part of these

rules.

![]() HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5837

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5837

![]()

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5841

SCHEDULE - II Form of Option

[See rule 6]

* (i) I, ___________________________________________ hereby elect the revised pay structure with effect from 1st January, 2016.

* (ii) I, ___________________________________________ hereby elect to continue on the existing pay

structure of pay of my

substantive/ officiating post

mentioned below

until:

* The date of my

next increment;

Date:____________________

Station:_________________

Signature _________________________________

Name _____________________________________

Designation _______________________________

Office in which employed__________________

* To be scored

out, if not applicable.

![]()

5842 HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK. 6, 1938 SAKA)

Rule 1― This rule is self-explanatory.

Rule 2― This rule lays down the categories of employees to whom the rules apply. Except for the categories

excluded under sub-rule (2), the rules are applicable to all persons under the rule making power of Government of Haryana serving in connection with the affairs of Government of Haryana and whose pay is debitable to the consolidated fund of the State of Haryana. These rules do not apply to

any

other categories

of

employees.

Rule 3― This rule is

self-explanatory.

Further, wherever the terms defined under this rule are mentioned in these rules or in any other rules/ instructions/ orders/ notifications etc. issued in connection with these rules, definitions as prescribed under this rule is to be taken as the meaning for and in these rules or, as the

case

may be, in any other rules/

instructions/ orders/ notifications etc.

Rule 4― This rule is self-explanatory.

Rule 5― The intention is that all Government employees should be brought over to the revised pay structure

except those who elect existing pay structure. The Government employees who exercise the option

to continue in the existing pay structure will continue to draw the dearness allowance and interim relief at the rates

in force on 1st January, 2016.

Rule 6― This rule prescribes the manner in which option has to be exercised and also the authority who shall be apprised of such option. The option has to be exercised in the form appended to the rules. It should be noted that it is not sufficient for a Government employee to exercise the option within the specified time limit but also to ensure that it reaches the prescribed authority within the time limit. In the case of persons who are outside India at the time of notification of these rules, the period within which the option has to be exercised is three months from the date they take over charge of the post in India. In the case of Government employees the revised pay structure of whose posts are announced subsequent to the date of issue of these rules, the period of three months will run from the date of such announcement. Persons who have retired between 1st January 2016 and the date of notification of these rules are also eligible to exercise option.

Rule 7― This rule deals with the actual fixation of pay in the revised functional pay scales on 31st December, 2015. For the purposes of these rules the procedure under this rule and no other procedure under a different rule shall be followed. The illustrations indicating the manner in which pay of Government employee should be fixed under this rule have been given below the respective rule.

Rule 8― This rule prescribes the method of fixation of pay of employees appointed on direct recruitment on

or

after 1st day of

January, 2016.

Rule 9 & 10― These rules prescribe the manner in which the next increment in the new pay structure shall be regulated. The illustrations indicating the manner in which increment of a Government employee

should be regulated

have

been given below the respective rule.

Rules 15― This rule relates to the overriding effect to the rule which provides that the provisions of these rules will regulate and the provisions of any other rule will not regulate the conditions as prescribed in these rules and to the extent of any inconsistency between the provisions of these rules and provisions of any other rules, the provisions of these rules shall prevail and apply.

Rules 16― There could be a possibility that these rules may cause some hardship in any particular case or to a class or category of posts. Under such circumstances the provisions of rule is clear that it has to be

invoked only if the Government is satisfied about the existence of some hardship which is required to be relaxed. The relaxation of such hardship shall be based on the merit of individual cases or the

cases or the cases of class and categories of employees where such hardship is found to be justified

for relaxation. Removal of such hardship would therefore, not amount to any discrimination where

such hardship has

either not been found to

exist or has not been found to

be justified for relaxation.

![]()

HARYANA GOVT. GAZ. (EXTRA.), OCT. 28, 2016 (KRTK.

6, 1938 SAKA) 5843

Rules 17― If the circumstances so requires the Government can add or delete or change any of the parameters as mentioned in the Schedule-I and may further direct the mode in which the provisions of these

rules

shall be applicable on such changes either generally or specifically. However, in event of

absence of any general or specific direction for the applicability

of the provisions laid down under

these rules, it shall be presumed that the entire rule

shall be applicable on

such changes

Rules 18 & 19― These rules are self-explanatory.

P. RAGHAVENDRA RAO,

Additional Chief Secretary to Government, Haryana Finance Department

54742—C.S.—H.G.P., Chd.

No comments:

Post a Comment

Your comment is valuable for us to improve the post.Thanks.